Objectives: Identify the purpose of the GAO’s Green Book. Distinguish between components of internal control. Distinguish between management objectives Choose a finite subject matter on which to apply controls Identify the auditor’s responsibilities regarding application of the Green Book Most of the changes between the 2011 Yellow Book and the 2018 Yellow Book that we […]

Blog

Has the GAO gone too far with audit quality control?

Objectives: Assess whether an audit team has met the Yellow Book requirements regarding quality control and peer review At the most basic level, the quality control requirements are twofold. The Yellow Book requires that audit shops: have an internal quality control system, and undergo an external peer review that determines whether the audit shop’s quality […]

Why would a government employee commit fraud?

Please enjoy the first chapter of “The Little Book of Local Government Fraud” by Charles Hall, CPA. An fun-to-read and informative self-study course available at Yellowbook-CPE.com. Objectives: Identify common characteristics of fraudsters Identify various types of fraud schemes Before we dig into fraud at the ground level of individual transactions, let’s take a look at local government fraud […]

Generating Cash Flow

Please enjoy this excerpt from the self-study text – The Four Principles of Happy Cash Flow – that I learned working with Dell and Walmart. The economy is rocking right now – but don’t forget the value of liquidity when times get tough! Learning Objectives Recognize the benefits of generating cash flow Identify the phases of the […]

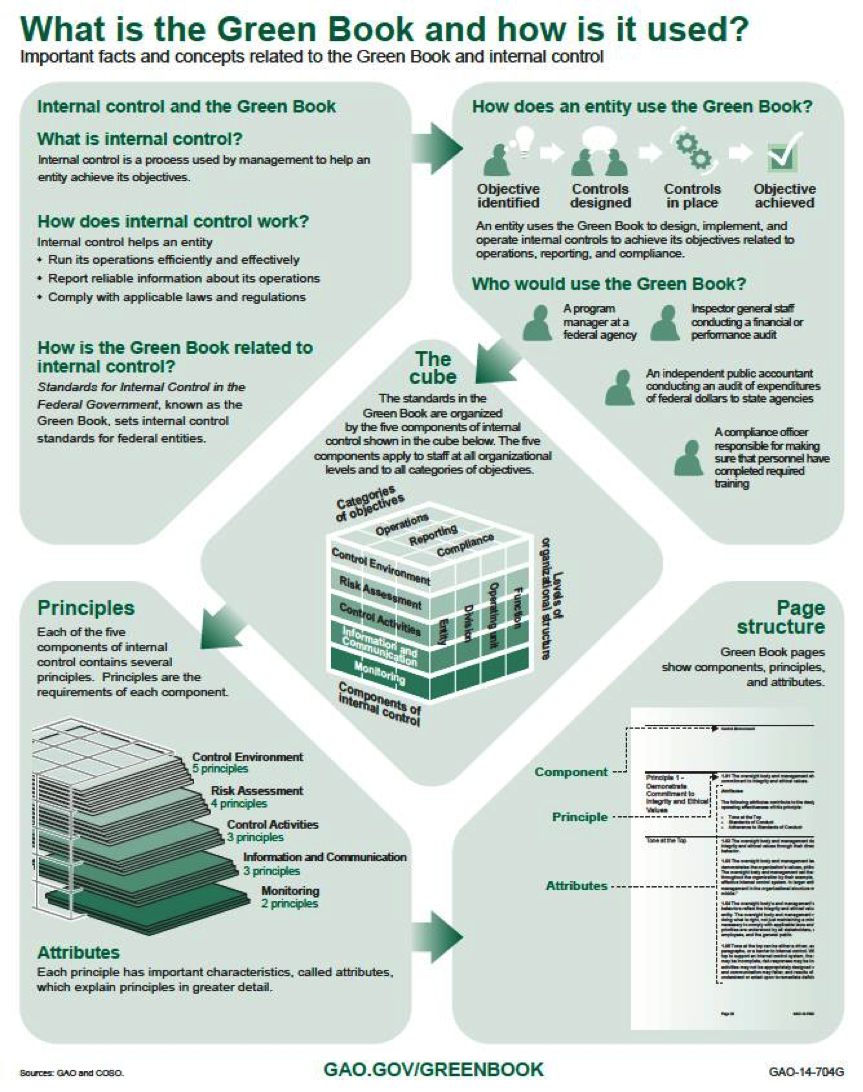

The Most Important Change to the Yellow Book is the Green Book

I’ve had a few months to digest the changes to the 2018 Yellow Book (Government Auditing Standards),and I’ve taught a few seminars and webinars about the changes. Most of the changes do not shock my audiences. But I am noticing that quite a few auditors are not familiar with the Green Book which was published by […]

Little frauds are a big deal in government.

Please enjoy Chapter 1 of An Auditor’s Responsibilities for Fraud in the Government Environment, available at Yellowbook-CPE.com. Objectives: Differentiate between auditing for fraud in the government environment and auditing for fraud in the commercial environment Fraud – it’s a costly thing! Whether it is committed in the government environment or the commercial environment, those who practice […]

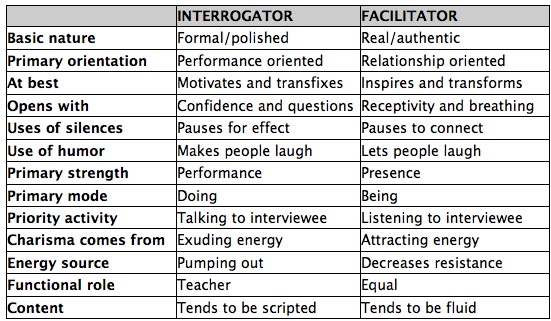

Why Auditors & Fraud Examiners Conduct Interviews

Please enjoy this excerpt from Chapter 1 of Interviewing Skills for Auditors, available here. Objectives: Distinguish between types of interviews Identify the benefits of establishing rapport during an interview Identify the benefits of having a productive, friendly relationship with the client Always remember the purpose of an interview – to get information. But because you are working with […]

Whas’ up with Your Team’s Writing?

Enjoy this first chapter from The Audit Report: Yellow Book Style by Leita Hart-Fanta available here. Objectives: Identify what is causing your team’s problems with report writing What’s Your Problem?: The Root of Writing Problems “What kind of writing issues does your staff have?” When a potential client calls to ask me to conduct a writing […]

General Principles & Basic Premises

Objectives: Differentiate between principles applicable to state and local governments and nonprofits Define key government regulators and their related acronyms Sequence the four layers of rules governing grants Introduction to Federal Cost Principles Now you’ve done it. You’ve taken on a federal grant – either to administer one or to audit one! Federal grants can be […]

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: