Description

6 hours of Governmental CPE credit ONLINE for $395

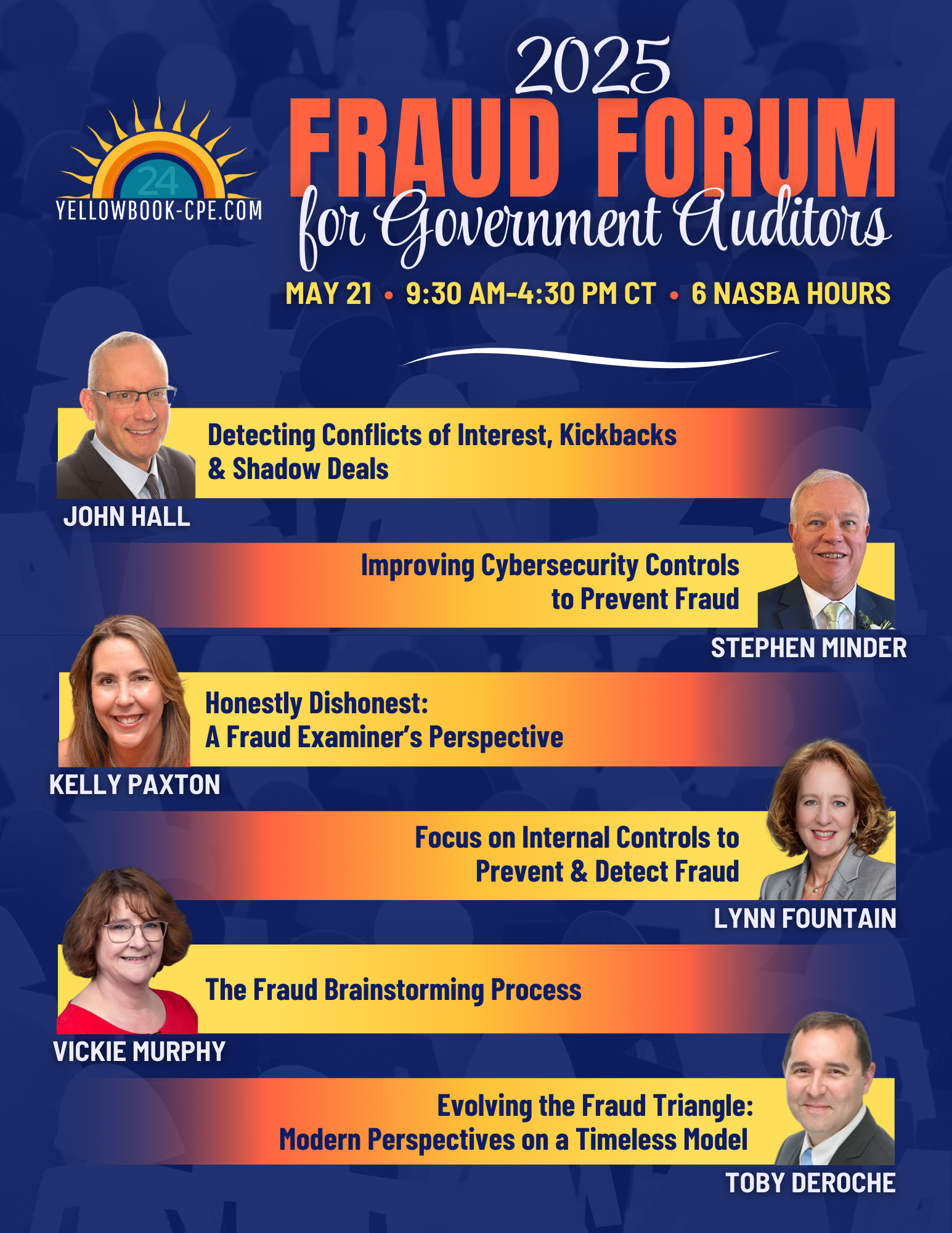

SCHEDULE

SESSION 1: 9:30 AM CT Detecting Conflicts of Interest, Kickbacks & Shadow Deals

SESSION 2: 10:30 AM CT Improving Cybersecurity Controls to Prevent Fraud

SESSION 3: 11:30 AM CT Honestly Dishonest: A Fraud Examiner’s Perspective

LUNCH BREAK: 12:30 PM – 1:00 PM CT

SESSION 4: 1:00 PM CT Focus on Internal Controls to Prevent & Detect Fraud

SESSION 5: 2:00 PM CT The Fraud Brainstorming Process

SESSION 6: 3:00 PM CT Evolving the Fraud Triangle: Modern Perspectives on a Timeless Model

END TIME: 4:00 PM CT

CONFERENCE INFORMATION

Date: Wednesday, May 21, 2025

CPE Credit Hours: 6

Field of Study: Auditing (Governmental)

Program Level: Basic

Prerequisites: None

Advanced Preparation Required: None

Who Should Attend: Government auditors

Instructional Method: Webinar (Group Internet Based)

SESSION 1

Detecting Conflicts of Interest, Kickbacks & Shadow Deals

‘Shadow deals’ exist when there are undisclosed details that intentionally mask the true nature of a relationship between an employee and an outsider. If known, these hidden details would often change management’s decisions covering grants, benefits, supply agreements, investments, lending, partnership and a long list of other routine business commitments.

In this session, we’ll examine the often inadequate and always difficult efforts to deter, surface and handle conflicts of interest, kickbacks and other shadow deals in government operations. We’ll cover what works and what doesn’t from real-world government case studies and other examples. We’ll build lists of common red flags and related next steps to move from suspicion to referral and conclusion.

Learning objectives:

- Determine why hidden relationships and other non-transparent details can completely upend management’s ability to oversee operations

- Identify the red flags of shadow deals in business relationships and transactions

- Recognize why conflicts of interest and other shadow deals surface more often by supervisors and employees than by audit and compliance specialists – and why that’s likely to always be the case

- Determine how to maneuver confidently from red flag detection to conflict of interest conclusions, even though the process may be inherently difficult

Instructor: John Hall, CPA

SESSION 2

Improving Cybersecurity Controls to Prevent Fraud

The need for cybersecurity continues to expand across all entities, including government audit shops. Cyber criminals span the full spectrum of nation states, criminal gangs, malicious hackers, and other individuals seeking recognition and/or profit. This last group may even be “insiders” who seek to damage their own organizations.

Both traditional and newer, innovative cybersecurity controls are critical elements to prevent organizational fraud and business interruption. This session will focus on examples of these control opportunities to consider in implementing, expanding, or evaluating a cybersecurity fraud program.

Learning objectives:

- Recognize cyber risk vulnerabilities

- Identify baseline technology controls for cybersecurity

- Compare technology infrastructure controls to enhance cybersecurity

- Describe the future of cybersecurity controls

- Determine how to establish audit protocols to evaluate cybersecurity controls

Instructor: Stephen W. Minder, CPA CIA CISA CFE

SESSION 3

Honestly Dishonest: A Fraud Examiner’s Perspective

Why do good people make bad decisions?

This ethics presentation will change government auditors’ ideas of how honest people behave. Using behavioral economics (think Dan Ariely and Richard Thaler), neuroscience and videos, this interactive webinar will have you rethinking what you thought you knew about people.

Learning objectives:

- Recognize how important Tone at the Top is for any size of government organization

- Describe how inexpensive or free tweaks may deter fraud in your audit shop

- Determine how people justify their behavior and look at themselves at the end of the day

- Identify how money can be replaced, but trust is much more difficult to regain

Instructor: Kelly Paxton, CFE

SESSION 4

Focus on Internal Controls to Prevent & Detect Fraud

Fraud continues to be perpetrated and has grown and expanded in various new and evolving risk areas. As technology continues to advance, so do the methods used to perpetrate fraud. In addition, fraudsters seem to become continually more intelligent by developing innovative ways to plague all facets of society, including government organizations.

In today’s digital world, internal controls are a critical element allowing organizations to prevent and detect fraud. Without proper internal controls, the “opportunity” portion of the fraud triangle is exposed. It has become an area where employees and other professionals can take advantage and perpetrate fraud.

This session reviews the top internal controls organizations can use to prevent and detect fraud. A great deal of information and statistics are taken from the Association of Certified Fraud Examiners Report to the Nations. Other valuable resources include the Kroll Fraud Report and the Committee of Sponsoring Organizations (COSO) fraud guidance.

Learning objectives:

- Review the internal control connection to fraud

- Identify the characteristics of organizations that fall victim to fraud

- Describe the importance of fraud awareness

- Identify the most frequently used fraud controls

- Review of the most successful detection methods for fraud

- Recognize anti-fraud methods at victim organizations

Instructor: Lynn Fountain, CPA CGMA CRMA MBA

SESSION 5

The Fraud Brainstorming Process

Most audit standards require government auditors to assess fraud risks – but what’s the best approach? In this session, we will break down a structured process for identifying significant fraud risks, ensuring you meet compliance with audit standards and strengthen your knowledge of fraud schemes.

Learning objectives:

- Describe the audit standards related to fraud risks

- Identify the steps involved in assessing fraud risks

- Define the process for determining which risks are significant to your audit objectives

Instructor: Vickie Murphy, CPA CIA CFE CGAP CICA CCSA CRMA

SESSION 6

Evolving the Fraud Triangle: Modern Perspectives on a Timeless Model

For nearly 70 years, the Fraud Triangle has served as the cornerstone for understanding fraud. However, it’s time for government auditors to reexamine this foundational model in an era of rapid technological advancements, evolving business landscapes, and shifting societal norms.

This session will explore how modern fraud schemes challenge the traditional framework, introduce three updated models that better address today’s complexities, and discuss the future implications for fraud detection and prevention strategies.

Learning objectives:

- Compare how modern fraud schemes expose gaps in the classic Fraud Triangle

- Contrast the classic model with three contemporary models challenging the traditional framework

- Determine how to predict future trends and their potential impact on fraud risk models and evaluation methods

Instructor: Toby DeRoche, MBA CIA CCSA CRMA CFE CISA SA cAAP

We look forward to seeing you at this fun and informative event!

Questions? You can find our FAQ here. To see a breakdown of how many polls and minutes of attendance are required for this webinar, see this page.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: