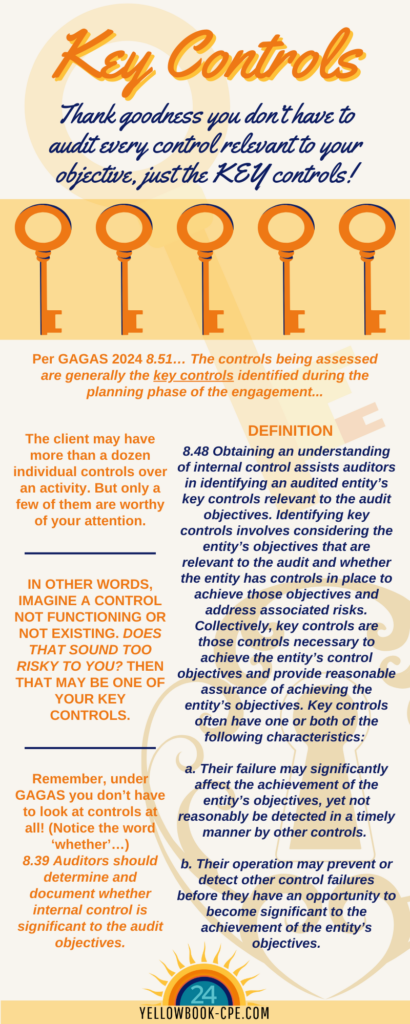

Thank goodness you don’t have to audit every control relevant to your objective, just the KEY controls!

Per GAGAS 2024 8.51… The controls being assessed are generally the key controls identified during the planning phase of the engagement…

The client may have more than a dozen individual controls over an activity. But only a few of them are worthy of your attention.

In other words, imagine a control not functioning or not existing. Does that sound too risky to you? Then that may be one of your key controls.

Remember, under GAGAS you don’t have to look at controls at all! (Notice the word ‘whether’…)

8.39 Auditors should determine and document whether internal control is significant to the audit objectives.

Key Controls definition

8.48 Obtaining an understanding of internal control assists auditors in identifying an audited entity’s key controls relevant to the audit objectives. Identifying key controls involves considering the entity’s objectives that are relevant to the audit and whether the entity has controls in place to achieve those objectives and address associated risks. Collectively, key controls are those controls necessary to achieve the entity’s control objectives and provide reasonable assurance of achieving the entity’s objectives. Key controls often have one or both of the following characteristics:

a. Their failure may significantly affect the achievement of the entity’s objectives, yet not reasonably be detected in a timely manner by other controls.

b. Their operation may prevent or detect other control failures before they have an opportunity to become significant to the achievement of the entity’s objectives.

Looking for high-quality and convenient CPE?

We have you covered! Our live webinars are a great choice if you want the learning to come to you. Just log on at the scheduled time and enjoy wherever you are! Here are a few of our upcoming courses:

- Apr 8: Smarter Risk Assessments for Government Auditors (4 CPE hours)

- Apr 10: Generative AI Case Studies: Lessons Learned in Public Sector Audit Shops (2 CPE hours)

- Apr 28: Using ChatGPT with Excel for Government Auditors (2 CPE hours)

- May 7: Internal Audit Strategy for Government Auditors (3 CPE hours)

- May 13: Continuous Improvement Tools for Government Auditing (2 CPE hours)

Need to do things at your own speed, but still get all your credits? Plan your CPE around your life, not the other way around! Yellowbook-CPE.com has dozens of self-study courses, including the Internal Controls Bundle. This helpful bundle uses simple and easy-to-understand terms to explain how the Green Book is the COSO model for government application.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: