In one month, I encountered three separate audit teams (one each at city, county and federal levels) struggling to overcome scope limitations. This is a very frustrating experience for the auditor and results in a significant waste of taxpayer funds.

What are scope limitations?

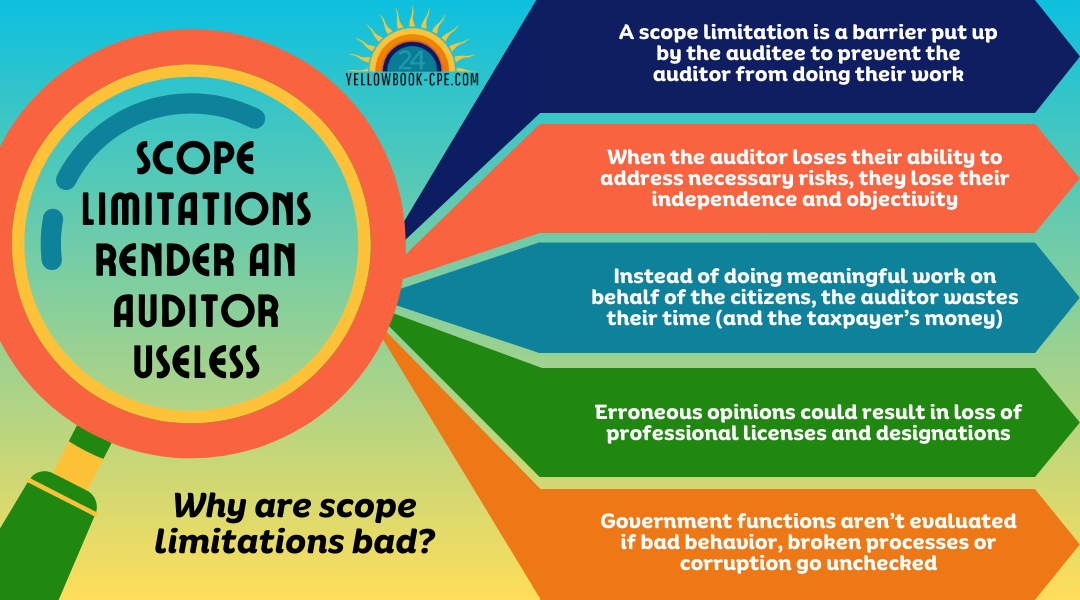

A scope limitation is a barrier put up by the auditee to prevent the auditor from doing their work. Maybe the auditee refuses to provide evidence or answer the auditor’s questions. Or, maybe the auditee blocks the auditor from looking at certain, sensitive subject matters.

The auditee is likely limiting the auditor’s access. Why? Because they have something to hide from those in charge of governance and the public.

But as my granny used to say, the auditees are ‘cutting their nose to spite their face.’

Why are scope limitations bad?

When the auditor loses their ability to address the risks as they deem fit, the auditor loses their independence and objectivity. Not to mention their professional credibility, too!

Persistent scope limitations can eradicate the auditor’s whole reason for existing. Instead of doing meaningful work on behalf of the citizens, the auditor wastes their time (and the taxpayer’s money) talking to lawyers and arguing with the auditee trying to get the evidence they need.

This section from the 2024 Yellow Book explains what government auditors do:

GAGAS 2024 1.05 Government auditing is essential in providing accountability to legislators, oversight bodies, those charged with governance, and the public. GAGAS engagements provide an independent, objective, nonpartisan assessment of the stewardship, performance, or cost of government policies, programs, or operations, depending upon the type and scope of the engagement.

Some auditors can break through the auditee’s barriers by issuing a subpoena or a public records request for the evidence they need. But in some cases, the language of the legislation creating the audit function renders the auditor impotent without any power to get the needed evidence.

One auditor makes a stand

The Inspector General of the Bay Area Rapid Transit Authority wrote this brilliant report introduction explaining scope limitations in powerful and clear language:

I was optimistic in my December 2020 message believing that my office had overcome obstacles and was making progress on achieving its goals. I regret to share that progress is at a standstill. Demands are still being made of us that would restrict who we can speak to, when, and under what circumstances. Further, our integrity has been called into question.

Some members of the BART Board of Directors, at the request of union leaders, are requesting that we add language to our charter that would remove our ability to conduct our work without undue influence. This action creates a culture of suppression that is not unlike the dismissal in 2020 of five federal inspectors general by the White House Administration for the direct interest of that administration.

Despite our commitment to the truth and adhering to professional standards that require we conduct our work ethically;

some Board members would like us to include the BART Employee Code of Conduct in our charter. This is because that code says that employees “shall not commit any act which may bring reproach or discredit upon the District.” The purpose of this addition is to claim that we are in violation of BART policy when, as required by California statute, we publicly issue audits or investigations that could potentially shed unfavorable light on the District. The very nature of our work means that we will sometimes bring forward bad news. Those who embrace public transparency and accountability understand that to be true and accept, without reservation, the work done by oversight bodies such as the independent Office of the BART Inspector General.

In our profession, we expect to sometimes be disliked and unwelcome.

What we do not expect is for those in public service to actively work against our goals for transparency rather than for the public who fund the services that they are entrusted to protect. Nevertheless, we will persevere and move ever forward, while continuing to follow our professional standards, which include a fundamental responsibility to serve the public interest with integrity and objectivity.

A very sad situation for the public indeed!

CPAs simply can’t put up with scope limitations

Certified Public Accountants (CPAs) in public practice have a concern if they issue an erroneous opinion, the client will sue the CPA causing them to lose their hard-earned credentials.

As such, the AICPA makes it very clear for CPAs in AUC-705. If a CPA cannot gather sufficient evidence due to a scope limitation, they must disclaim an audit opinion. ‘Disclaiming an audit opinion’ is a fancy way of saying the CPA drops the audit. Instead, they publish a report describing the audit scope limitations in detail.

After a CPA disclaims an opinion, they write it off as a loss. Then they quickly move on to audit the next client.

It isn’t that pat for other auditors

Auditors who work inside the government they audit could also be unable to reach a conclusion or opinion due to scope limitations. But, unlike a CPA in public practice, they don’t have another client to audit. Then they can get stuck, unable to move ahead and do their job.

Eventually, folks notice auditors spending their days twiddling their thumbs with nothing to do other than fight against the scope limitation. From there, they will lose their funding and the audit office will close.

When an auditor gets stuck or is eliminated, the auditee may erroneously believe they have won their freedom from auditor tyranny.

Scope limitations usually don’t end well for the auditee

But freedom’s just another word for nothing left to lose. The auditee may not recognize it, but they have plenty to lose.

What if the auditee is left without anyone objective and independent who can tell the truth about what is going on in the organization?

I once served on the finance committee of a large church. They had not been audited in 12 years. When I came onboard, I argued they should follow the rules of the synod and get an audit as soon as possible. If something negative was going on, they needed to nip it in the bud immediately. They must show their parishioners they are good stewards of the church’s resources. If a financial scandal broke and it came to light the board ignored the rules and refused an audit, every executive and board member would be ousted.

Limiting the auditor’s scope may seem like a grand idea in the short run because no one likes to be evaluated. But that means other functions in the government are also not being evaluated! If bad behavior, broken processes or government corruption go unchecked, something seriously undesirable can happen.

I once worked for a government agency that became arrogant and corrupt due to weak controls and a toothless audit function. Consequently, the legislature fired all of the executives and distributed the programs to more responsible agencies.

Wise auditees keep their nose on their face

Instead of preventing auditors from having access to information, wise auditees will welcome feedback from auditors. They truly care about doing the right thing for the citizens they serve.

The biblical version of ‘cutting your nose to spite your face’ is in Proverbs 15:32. Whoever ignores instruction despises himself, but he who listens to reproof gains intelligence.

Maybe that is where my granny got that saying…?

Personally, I’d like everyone to keep their noses AND do right by the public. How about you?

Want to learn more?

The self-study Audit Reporting Bundle is just what you need to get up to speed! Complete the included two courses, one video and one self-study. Purchasing as a bundle saves $75 and provides 11 hours of Yellow Book qualifying CPE credit. By the end, you’ll be able to differentiate among the contents of a performance audit report. That includes the audit objective, scope and methodology, and audit results.

Need more in-depth training? I invite you to join me for one of my most popular classes, the Virtual Audit Bootcamp scheduled for December 9-13. We explore each phase of conducting a government audit while complying with significant Yellow Book and IIA standards. Learn and create key audit deliverables (such as objectives, risk assessment, key controls, findings, tests, and audit documentation) to succeed as an auditor. And there’s a bonus to help you develop your interviewing skills! Earn 7 extra hours of CPE at your own pace with a complimentary self-study course, Interviewing Skills for Auditors.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: