Description

6 hours of Governmental CPE credit ONLINE for $395

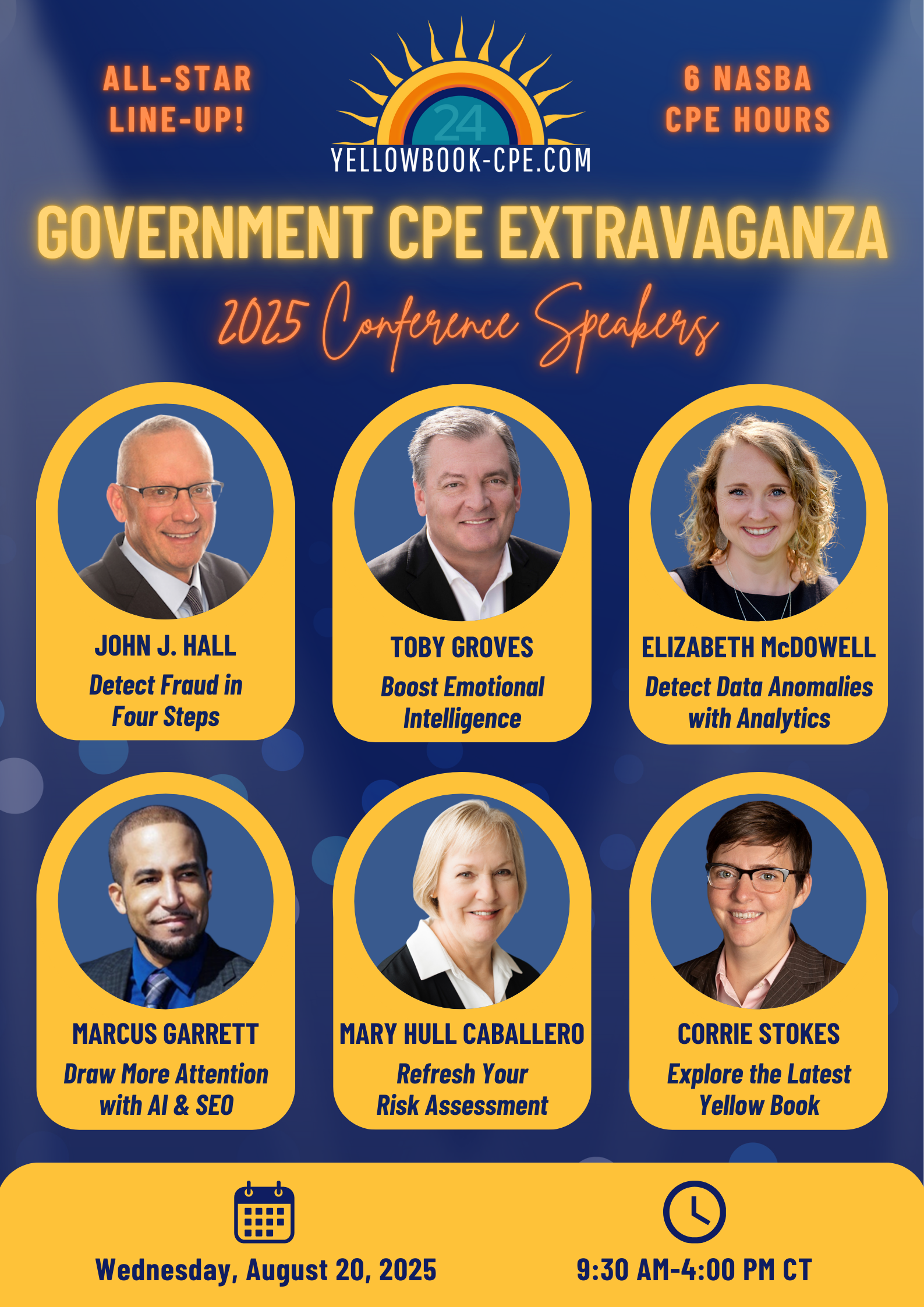

SCHEDULE

SESSION 1: 9:30 AM CT Detect Fraud in Four Steps

SESSION 2: 10:30 AM CT Boost Emotional Intelligence

SESSION 3: 11:30 AM CT Detect Data Anomalies with Analytics

LUNCH BREAK: 12:30 PM – 1:00 PM CT

SESSION 4: 1:00 PM CT Draw More Attention with AI & SEO

SESSION 5: 2:00 PM CT Refresh Your Risk Assessment

SESSION 6: 3:00 PM CT Explore the Latest Yellow Book

END TIME: 4:00 PM CT

CONFERENCE INFORMATION

Date: Wednesday, August 20, 2025

CPE Credit Hours: 6

Field of Study: Auditing (Governmental)

Program Level: Basic

Prerequisites: None

Advanced Preparation Required: None

Who Should Attend: Government Auditors

Instructional Method: Webinar (Group Internet Based)

SESSION 1

Detect Fraud in Four Steps

Regardless of what professional standards say, government auditors are expected to surface hidden problems, including wrongdoing, theft and fraud. Audit risk brainstorming should bring precision and clarity to detection expectations, red-flag lists and sampling approaches. And no auditor should proceed with fieldwork without clear expectations from their audit leaders when it comes to fraud risks.

In this session, participants will examine their fraud detection approach and build stronger, better and more effective steps to surfacing wrongdoing, theft and outright fraud.

Learning objectives:

- Recognize the four steps needed on every audit project to reveal hidden issues, including theft and fraud

- Determine why asking your audit leader exactly what’s expected on every project is critical to building audit detection actions

- Identify how to efficiently and effectively brainstorm fraud and related risks

- Describe the fool-proof ‘Secret Sauce’ to bake into your fraud detection work and why it works every time

- Determine how to build an action checklist to plug the gaps between fraud detection expectations and action on each audit project

Instructor: John J. Hall, CPA

SESSION 2

Boost Emotional Intelligence

Emotional intelligence (EI) deeply influences our reasoning, shaping how we prioritize, interpret, and present information. It’s crucial for government auditors, affecting judgment and decision-making.

This session delves into emotional intelligence’s role in auditing, focusing on enhancing this skill to improve our thinking and effectiveness as auditors. We’ll explore strategies to boost emotional awareness and mastery, vital for navigating government audit challenges. Attendees will learn how to elevate their emotional intelligence and communication, key for mastering complex professional interactions and audit engagements.

Learning objectives:

- Recognize how emotional intelligence (EI) enhances cognitive functions, leading to more effective information processing and decision-making in government audits

- Identify how EI aids in setting priorities and making judgments that align with both analytical findings and government stakeholder expectations

- Recognize how EI facilitates understanding diverse viewpoints, improving client interactions and audit assessments

- Identify practical approaches to incorporate EI skills into daily government auditing tasks to enhance overall audit quality

Instructor: Dr. Toby Groves

SESSION 3

Detect Data Anomalies with Analytics

Efficient and effective data analytics are for all government audit shops – large or small! This 1-hr data analytics session will teach actionable techniques any government auditor can learn.

Major subjects:

- Data Analytics Overview – Understand what data analytics is and what it isn’t. Learn how to get started – what data exists and how clean it is, what tools are available, and what are the goals?

- Data Analytics Through Government Audit – Understand what analytics can be performed in audit planning. Use planning analytics to drive testing strategy in fieldwork. Identify “quick win” data analytics to improve all parts of the audit process

- Data Automations & Visualizations – Learn about simple automations created with Microsoft products. Innovate your audit reports with beautiful data visualizations

Learning objectives:

- Identify how to get started with data analytics

- Determine how to perform data analytics in all steps of the government audit process: Planning, fieldwork, and reporting

- Identify how to create simple automations and improve audit report visualizations

Instructor: Elizabeth McDowell, CPA CIA

SESSION 4

Draw More Attention with AI & SEO

Unlock the Artificial Intelligence (AI) advantage and set a new standard for your audit reports!

Government auditors should leverage – not fear – the power of AI. Coupled with search engine optimization (SEO), AI can help you enhance the accessibility, clarity, and impact of your audit reports. Explore how various AI-driven tools can revolutionize the way government audit reports are written, presented, and discovered online.

Learn practical strategies and real case studies for integrating AI directly into audit workflows, refining content with SEO best practices, and transforming complex reports into easily digestible information. No matter your level of audit experience, this session will provide actionable techniques to elevate your reports.

Learning objectives:

- Identify AI prompts through real world case studies and how they improve writing, editing, and formatting audit reports

- Determine how to modernize your audit reports to reach the right audience on the right platforms with critical audit findings

- Recognize how to harness AI tools to streamline audit report writing, structure content for maximum clarity, and apply SEO strategies to improve accessibility, transparency, and stakeholder engagement

Instructor: Marcus Garrett, CIA

SESSION 5

Refresh Your Risk Assessment

As Bob Dylan put it, “The times they are a-changin’.” Nowhere is that truer than in the government landscape, which keeps shifting at warp speed with no sign of slowing down. Audit shops must pick up the pace in identifying organizational risks and rethink their annual assessment cycles. It is past time to replace passive “What should we audit?” methods with more effective internal and external engagement to ensure scarce audit resources are applied where they will do the greatest good. Concepts from other parts of the audit process, such as continuous monitoring and agile auditing, can inform faster and more relevant risk assessments, adding value.

Learning objectives:

- Distinguish between organization-level and engagement-level risk assessments (Red Book Standards 9.4 and 13.2, GAGAS 8.36-8.38)

- Compare GAO’s Green Book: Objectives of an entity (OV2.16-OV2.24) and Red Book’s standard for understanding governance, risk management, and control processes (Standard 9.1)

- Recognize the value and challenges of taking an enterprise perspective of government risk versus the traditional management model focused on risk type

- Determine methods to make organization-level risk assessments more agile and relevant

Instructor: Mary Hull Caballero

SESSION 6

Explore the Latest Yellow Book

The Government Auditing Standards, or Yellow Book, provide a framework to guide government auditors to do high-quality audit work with competence. In this 1-hour session, we will cover the changes to the standards released by GAO in 2024 and the related implementation timeframe. We will also identify the various sections of the standards relevant to performance audits and discuss the intent of each section.

Learning objectives:

- Recognize the topics covered by GAO’s Government Auditing Standards (Yellow Book)

- Identify the Yellow Book requirements that apply to performance audits

- Describe the 2024 changes and updates to the Yellow Book

Instructor: Corrie Stokes

We look forward to seeing you at this fun and informative event!

Questions? You can find our FAQ here. To see a breakdown of how many polls and minutes of attendance are required for this webinar, see this page.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: