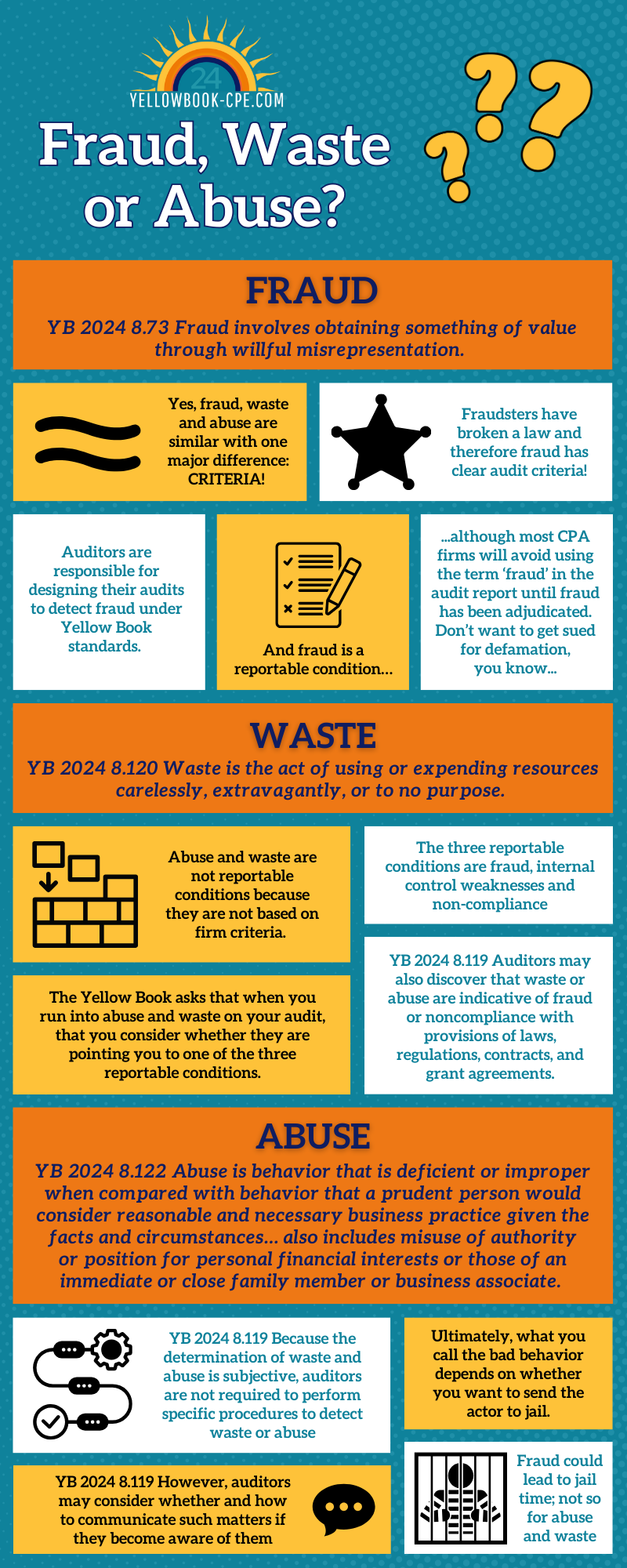

Fraud, Waste or Abuse?

Fraud, waste and abuse are all similar with one major difference: CRITERIA! The only reportable condition is fraud as the other two are subjective and not based in criteria.

Fraud

YB 2024 8.73 Fraud involves obtaining something of value through willful misrepresentation.

Fraudsters break a law, therefore fraud has clear audit criteria! Auditors are responsible for designing their audits to detect fraud under Yellow Book standards. Although most CPA firms will avoid using the term ‘fraud’ in the audit report until fraud has been adjudicated. Don’t want to get sued for defamation, you know…

Waste

YB 2024 8.120 Waste is the act of using or expending resources carelessly, extravagantly, or to no purpose.

The Yellow Book asks when you run into abuse and waste on your audit, you consider whether they point you to one of the three reportable conditions: Fraud, internal control weaknesses and non-compliance.

YB 2024 8.119 Auditors may also discover that waste or abuse are indicative of fraud or noncompliance with provisions of laws, regulations, contracts, and grant agreements.

Abuse

YB 2024 8.122 Abuse is behavior that is deficient or improper when compared with behavior that a prudent person would consider reasonable and necessary business practice given the facts and circumstances… also includes misuse of authority or position for personal financial interests or those of an immediate or close family member or business associate.

YB 2024 8.119 Because the determination of waste and abuse is subjective, auditors are not required to perform specific procedures to detect waste or abuse. However, auditors may consider whether and how to communicate such matters if they become aware of them.

Ultimately, what you call the bad behavior depends on whether you want to send the actor to jail.

Fraud could lead to jail time. Not so much for abuse and waste.

Want to learn more?

For more on the reportable conditions and an auditor’s responsibility to uncover them, enjoy the self-study Essential Auditing Skills and Techniques for the Government Auditor. Once completed, you’ll earn 9 hours of relevant CPE for only $120.

Need even more CPE hours? This course is also included in the Essential Skills Bundle and the Performance Audit Essentials Bundle.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: