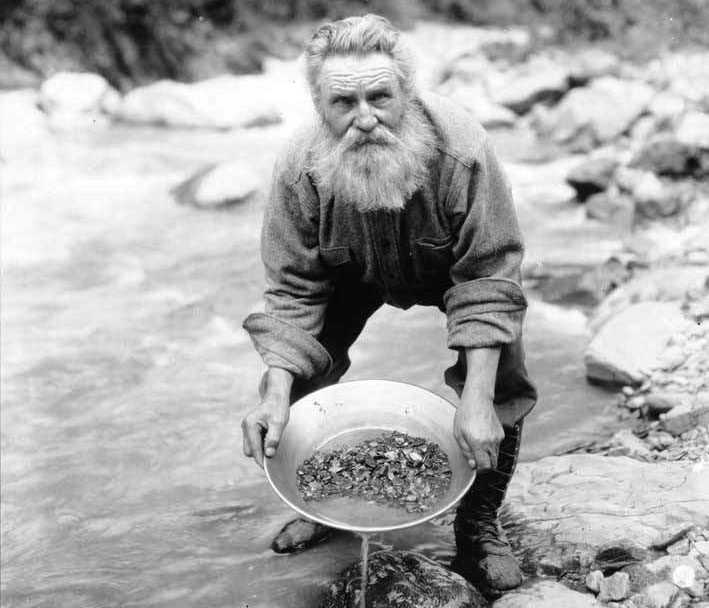

I get calls from CPAs in public practice every so often. They heard a rumor that auditing government programs is lucrative and they see gold in them there hills!

But an audit of government grants is pretty darn involved and I feel like I should warn them of a few things before they start cultivating a new client base.

If you are still reading, that means that I am warning YOU. So here goes:

Warning! You have to follow the Yellow Book to audit government grants

I regularly teach full day seminars on Yellow Book standards (which by the way, you are going to have to follow!) and at about 1 o’clock, the attendees start grousing about getting out of government auditing.

I even had one woman in San Francisco stand up and offer her only government client to anyone who was interested – because she was D.O.N.E.! It was like a live e-bay auction. Another CPA took her card and agreed to take over for her. She was thrilled.

What is the Yellow Book anyway? It is also known as Generally Accepted Government Auditing Standards or GAGAS. (How is that for an attractive acronym?!?) The Yellow Book is written by the Government Accountability Office, the legislative auditor for the federal government.

Three layers of standards

Here is how the standards stack up: The Uniform Guidance requires that Single Audits be conducted in accordance with GAGAS. Inside GAGAS, the Single Audit is classified as a financial audit. Financial auditors must follow Yellow Book as well as the AICPA SASs.

So, did you catch that? In order to do the Single Audit, you follow three layers of standards and audit requirements:

1. The Single Audit requirements

2. GAGAS

3. The AICPA’s SASs

Whew, I am tired just thinking about it!

This wasn’t that big a deal when I started conducting Single Audits in the late ’80s. All three standard-setting bodies were slow-moving and quiet before the Enron debacle at the turn of the century. Since then, the AICPA and GAO standards have been in a constant state of flux. The Uniform Guidance even got updated! While all that change is great for my business as an instructor, it isn’t so great for practitioners.

What is so tough about the Yellow Book?

Here are a few things that trigger a “You’ve got to be kidding!?!” response from the participants in my Yellow Book seminars:

1. Specific training: GAGAS requires auditors to get 80 hours of training that enhances their ability to conduct audits every two years. Out of this 80 hours, 24 of it must be in government topics or topics relevant to your audit environment. This means that your tax update or estate planning courses won’t count!

2. Extra nagging regarding independence: While the GAO doesn’t specifically prohibit auditors from creating financial statements for their audit clients, they definitely don’t like it. The GAO puts up as many barriers as they can to prevent auditors from both creating and auditing financial statements.

This causes lots of angst during my seminars because auditors believe three things:

1. Their tiny client can’t create the financials or won’t pay for a third party to prepare them.

2. The client expects the auditor to do it.

3. The auditor’s life is easier if they create the financials they end up auditing.

Unfortunately, the GAO isn’t exactly sympathetic to any of those views. But just like a nagging but ineffective parent of teenagers, they are always talking but never putting their foot down or taking the keys to the car. This is something to keep your eye on when each revision comes out.

3. The GAO isn’t happy just hearing about symptoms; they want a diagnosis of the root cause. In order to enhance transparency and accountability in government, GAGAS asks that auditors don’t stop at simply pointing out flaws in the client’s operations or in compliance. The GAO wants to know why the flaw occurred, whether it is a big deal, and what should be done about it.

The GAO asks auditors to describe the elements of a finding (condition, effect, cause, criteria, recommendation) in their audit report. This causes extra work for the auditor, because the effect and root cause don’t usually present themselves to the auditor on a silver platter.

If all that sounds OK to you, great. Maybe you could make some money if you audit government grants.

But I don’t recommend playing the middle and just dabbling in government auditing. You are really going to have to know your stuff because the grantees (being governments that are tasked with preserving public resources) have to go out for bid each time they choose an auditor. That means that in order to make a profit, you are going to have to run lean and mean to beat out your competitors while simultaneously meeting all the regulatory expectations.

Most practitioners decide to either make government auditing a significant part of their practice or walk away from it all together.

Just don’t ever say I didn’t tell you.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: