Description

$275 (per person) includes an online webinar for 4 hours of CPE credit

Discover how to identify and document sufficient and appropriate evidence in compliance with auditing standards to support audit results and impactful recommendations.

This webinar builds on basic concepts and tasks to expand participants’ understanding of why evidence is the foundation of audit decisions and shapes the overall message in audit reports. Participants will also gain skills and best practices for documenting work throughout the audit cycle.

This course is ideal for both new and experienced auditors, whether in team member or team leader roles. Don’t miss this chance to experience an engaging course to learn new skills. Once applied, your critical thinking, performance, and communication will improve with internal and external stakeholders.

This insightful 4-hour webinar features Frank W. Jones, a governmental auditor, manager, and trainer from the Treasury Inspector General for Tax Administration with over 35 years’ experience leading teams to execute complex audits of the Internal Revenue Service. Frank is an award-winning trainer for the Council of the Inspector General on Integrity and Efficiency (CIGIE) and routinely delivers engaging presentations at conferences for the audit community.

Learning objectives:

- Identify the authority giving auditors access to data

- Compare the types, strengths, and weaknesses of evidence

- Describe the role of evidence and strategic planning

- Compare the relationship between audit objectives and gathering evidence

- Describe steps auditors can take to obtain reasonable assurance of the accuracy, reliability, and relevance of evidence

- Describe how to use researchable questions to help identify and evaluate evidence to assess risk, internal controls and design audit scope and methodologies

- Determine best practices to gather and document evidence during the audit cycle

- Recognize steps to practice professional skepticism

- Review evidence to develop the elements of a finding

- Describe steps to document and index work papers to support audit work

- Define referencing guidelines that assist quality assurance efforts

Program Level: Basic

Field of Study: Auditing (Governmental)

Who Should Attend: Governmental auditors

Prerequisites: None

Advanced Preparation Required: None

Instructional Method: Webinar (Group Internet Based)

CPE Credit Hours: 4

Date: Wednesday, July 30, 2025

Time: 12:00 p.m. – 4:00 p.m. Central

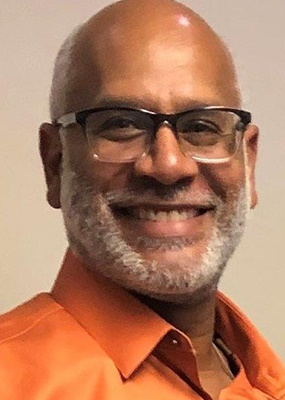

Webinar Leader:

Frank W. Jones, CIA

Frank Jones currently serves as a Management Analyst with the Treasury Inspector General for Tax Administration (TIGTA) in Atlanta, GA. Frank previously served as an Audit Manager in the Returns Processing and Account Service program and as an Audit Director in the Compliance and Enforcement Operations Program. His auditable areas included IRS’s Small Business/Self Employed and Wage and Investment Income Operating Divisions functional offices that include Examination, Collection, Criminal Investigation, Office of Professional Responsibility, Field Assistance, Electronic Tax Administration, Media and Publications, and Stakeholder, Partnership, Education and Communication. Frank is an auditing instructor for TIGTA and has served as a Council of Inspectors General on Integrity and Efficiency (CIGIE) adjunct instructor since 2009. In addition, Frank regularly presents at Institute of Internal Auditors, Association of Local Government Auditors and the Association of Government Auditors conferences.

Frank began his career with the IRS Inspection Service in 1989 and has been with TIGTA since its establishment in 1998. While with TIGTA, he has participated in several notable customer service reviews where Frank and his team have played the role of taxpayers and conducted anonymous visits to IRS Taxpayer Assistance Centers and Volunteer Income Tax Assistance sites. For this review, auditors evaluated IRS employees and volunteers’ ability to correctly answer tax law questions and prepare accurate tax returns. During the 2008 filing season, Frank expanded his efforts and his team conducted anonymous visits to unenrolled commercial tax return preparation companies. The results from these reviews were instrumental in the IRS establishing the Taxpayer Assistance Blueprint and Paid Preparer Strategy.

Frank has received CIGIE awards for innovative customer service performance audits, the inaugural Adjunct Instructor Training Award of Excellence (2016) and the Barry R. Snyder Joint Award of Excellence (2024) for his contribution helping redesign the Introductory Auditor Course. Frank is a mentor with more than 35 years of auditing experience. The unique blend of high energy and positive outlook on life makes his presentations motivational, leaving class participants excited and enthusiastic about the auditing profession. His educational mission is to inspire all students to go from being good to great auditors.

Frank has a BA in Accounting and Finance from Loyola University in New Orleans, Louisiana, and is a Certified Internal Auditor. Frank lives in Stone Mountain, GA with his wife Lori. In his free time, Frank enjoys coaching basketball, reading, playing on-line chess, fantasy football, and spending time with his family.

Questions? You can find our FAQ here.

To see a breakdown of how many polls and minutes of attendance are required for this webinar, see this page.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: