Special thanks to our featured speaker, Toby DeRoche, for contributing this valuable article on recognizing fraud and allowing Yellowbook-CPE.com to publish it.

Recognizing fraud in everyday settings

Auditors rarely look for fraud. We spend time confirming information is correct, but seldom actively search out red flags. Most auditors also only have a basic understanding of fraud red flags. With limited knowledge, it is hard to expect a typical auditor to recognize fraud red flags unless these are explicitly detailed in the test procedures. The information posted here will review the basics of identifying fraud and introduce the idea of customizing fraud models for specific scenarios.

Awareness training is key

To recognize fraud, you first need to know how it looks. Auditors should be able to identify red flags indicating fraud may have been committed and understand the most common fraud schemes and scenarios. Understanding the fraud triangle is the starting point for awareness training, and then comes scenarios.

The fraud triangle

In an audit, the fraud triangle helps you identify who will most likely commit fraud. The traditional fraud triangle has three sides: pressure, opportunity and rationalization. As illustrated below, most red flags are derived from these three categories.

- Pressure is a financial incentive that motivates someone to commit fraud. For example, a person might be under financial pressure because they have lost their job or have a gambling addiction.

- Opportunity is the ability to commit fraud without being detected. For example, someone might have the opportunity to commit fraud because they have access to sensitive financial information or because they are in a position of authority.

- Rationalization is the way that someone justifies their fraudulent behavior to themselves. For example, someone might rationalize their fraud by telling themselves they will only borrow money and will pay it back.

In the traditional model, all three elements of the fraud triangle must be present for fraud to occur. If there is no pressure, opportunity or rationalization, then fraud is less likely to occur.

Scenario awareness

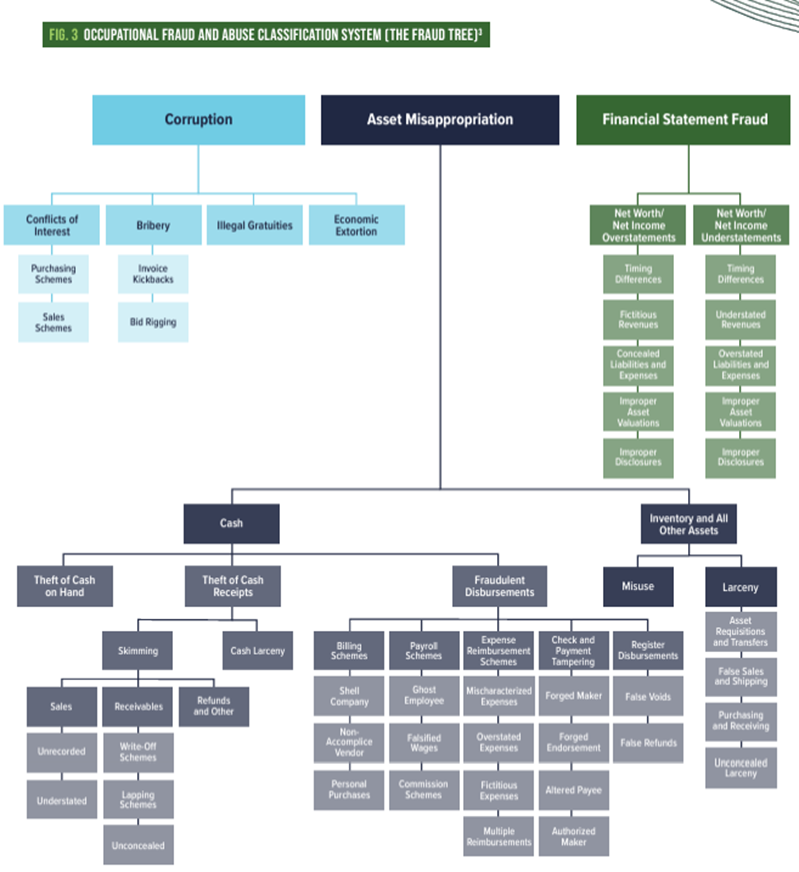

Learning scenarios often comes from experience, but there are two great resources to get a head start: the fraud tree and stories about fraud cases. The goal is to understand three components: what the fraudster did, their motivation and how the fraud was uncovered.

The fraud

The fraud itself is the first part of the story. For example, I often receive calls and messages from people claiming they are from the IRS, threatening to have me arrested if I fail to pay back taxes that day. The fraudster plays on a common fear since most people are uncomfortable dealing with the IRS, and taxes are notoriously complicated in the US. They are smart by adding in a threat of arrest and putting a time element that must be done today. The actual fraud then requests an immediate wire transfer.

The motivation

Finding a fraudster’s motivation can be impossible. We can say it is obvious that they want money, but you may never know the underlying reason. Most financial motivation stems from high bills, lost employment, gambling debts, etc. However, some fraudsters have political or ideological motivations, and some want the challenge. Learning what motivated a fraudster in real cases helps you know what to look for in the field. For example, I once had a coworker who committed credit card fraud for years. His motivation was to take care of his sick mother.

The investigation

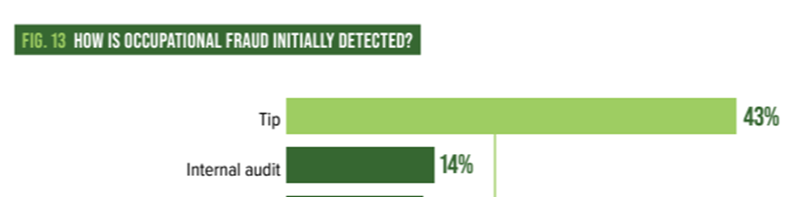

Finally, at some point, the fraud was uncovered. From the ACFE’s Report to the Nations, we know that most fraud is reported through a tip, meaning we only know because someone else told us. Audit uncovering a fraud is a distant second place.

I believe we can do better. First, we can become more familiar with fraud through study and stories. Then, we need to incorporate fraud testing procedures into every audit. The key is to know when to stop. If you are not a fraud examiner, you should take the audit to the point when you have established red flags exist, then bring in the experts for the formal investigation.

Conclusion

Once you have the basics—the fraud triangle, the fraud tree and a commitment to looking for fraud on your audit—you have the keys to recognizing fraud in the real world. When you realize that your job is just to identify red flags, not to prevent all fraud from occurring or even to conduct the full investigation, the task is much easier, and you will probably realize that red flags are very common.

The fraud tree

By the way, here is the fraud tree for reference:

Want to learn more about recognizing fraud?

Then you’re in luck! Join Toby DeRoche on May 29 for his live two-hour webinar, Would You Recognize Fraud? Government Cases. Students will review real government fraud cases to understand the schemes and how they were discovered. The stories are fascinating, and the way they were uncovered is critical to our success as government auditors.

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: