Special thanks to our featured speaker, Douglas Hileman, FSA CRMA CPEA P.E., for allowing Yellowbook-CPE.com to republish this valuable white paper. 3 Attributes of ESG Reporting That Differ from Financial Reporting was originally published on www.douglashileman.com, March 2022.

Introduction

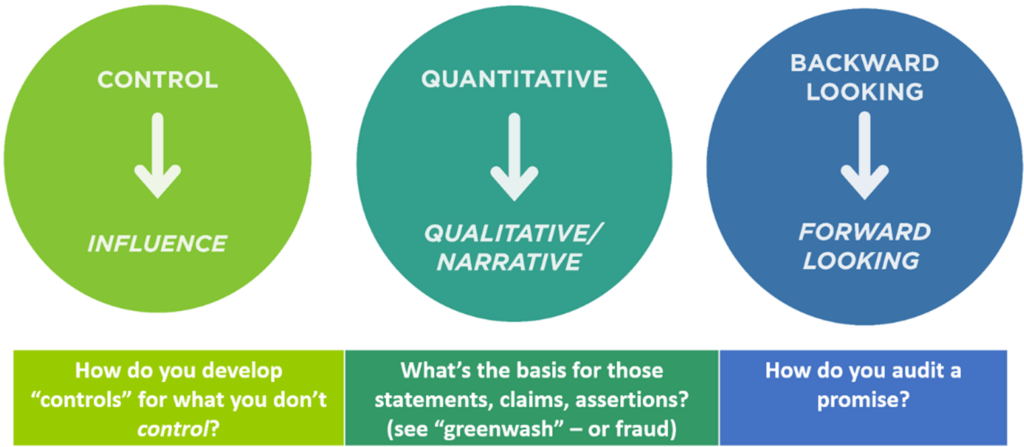

The author suggests there are three core attributes of sustainability reporting that differ from financial reporting and disclosures.

- Control and Influence

- Quantitative and Qualitative

- Retrospective and Prospective

Accountants, internal auditors, assurance providers, and others with experience in financial reporting and disclosures are becoming more involved in ESG reporting(1) and disclosures. There are already professionals who were involved in sustainability programs, reporting and reviews as they evolved. As a result, understanding these can help bridge the gap. Also, it can improve the effectiveness and efficiency of organization’s governance, strategy, risk management, as well as financial performance and positive impact in non-financial areas.

The Attributes

Attribute #1: Control and Influence

ESG reporting extends beyond what organizations control, and into what organizations can influence.

Organizations extended requirements for environmental and quality management systems into their supply chains for over two decades. Major auto makers required companies in their supply chain to obtain ISO 9001 and ISO 14001 certifications in the 1990s. The 2015 update to ISO 14001 emphasized the life cycle approach to environmental management, including supply chain and value chain.

Conflict minerals laws (Dodd-Frank in the U.S., other laws abroad) require companies to obtain data from supply chains. The objective of these laws is to influence suppliers to procure critical minerals from sources that followed internationally accepted standards for due diligence. Modern slavery laws require companies to perform due diligence in their supply chain. The UK Modern Slavery Act requires public reporting. These laws intend to incite companies to influence their supply chain to ensure these human rights abuses do not exist in their supply chain. Top performing companies can pursue other “downstream” objectives, achieving competitive advantage with their customers and business partners.

The SEC proposed rule on climate-related financial disclosures begins with Greenhouse gas (GHG) emissions – a proximal contributor to climate change. Organizations can control some GHG emissions, but they can influence much more. For example, organizations can request (or insist) landlords purchase power from renewable sources. They can specify lower-carbon goods or services in their supply chain. Organizations can change the design of products or packaging. Basically, they are expected to influence GHG emissions, report the process and the associated improvements.

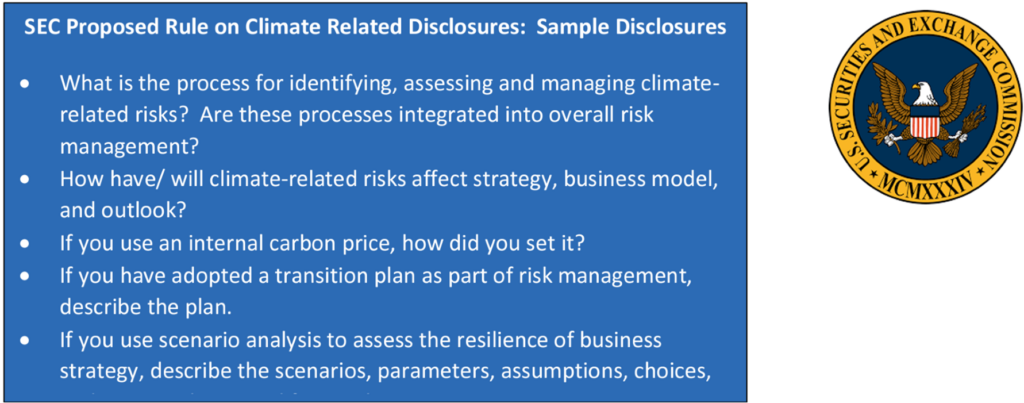

Attribute #2: Quantitative and Qualitative

As financial reporting does, ESG reporting includes quantitative information. Also, it includes metrics associated with labor force (board, executive and management team by gender or other attribute; relative compensation by those metrics, etc.) It can include data on water withdrawal by source, water usage, and safety statistics. It also includes GHG emissions inventories. Scope 1 and Scope 2 GHG emissions are the standard initial expectations. For most companies, Scope 3 emissions comprise the largest segment of overall GHG emissions. Companies often report some categories of Scope 3 emissions as their programs mature.

ESG reporting and disclosures also include an abundance of narrative. In reality, the qualitative narrative can stand on its own, or it can provide context to quantitative data. What is the company’s philosophy and approach on key topics? What are the company’s efforts to improve workforce diversity and inclusion? How are they funded, are they working, and how does the company know? For the water withdrawn and used in company operations, how much of this is in water-stressed areas? How has the company engaged with stakeholders to safeguard sufficient amount and quality of water for the community? Is wastewater used (or usable) for other purposes? For instance, irrigation, groundwater recharge, etc.

For the most part, the proposed requirements are narrative in the SEC’s proposed rule on climate change disclosures. They involve governance, strategy, and risk management (see box), and go to the heart of the business.

Attribute #3: Retrospective and Prospective

Attribute #3: Retrospective and Prospective

Financial reporting is often described as a snapshot. It is a concise retrospective look at the prior reporting period (income statement), and a snapshot of the organization’s condition at a point in time (balance sheet). Companies include forward-looking content in supporting notes, in management discussion and analysis. But first, it all begins with the snapshot.

ESG reporting tilts more heavily towards prospective content. Stakeholders evaluate not only the snapshot, but what companies commit to doing. Plus, how they perform compared to previously-announced commitments or targets.

Safety was an early example. It is a noble and commendable to aim for zero safety injuries and incidents. But everybody is human, and perfection is not attainable. If any injury ruins the achievement of a goal, this can have the unintended effect of suppressing complete and accurate reporting. Consequently, companies learned to set goals that were ambitious and achievable. Plus, they provide resources and controls to pursue them.

Additionally, companies have set other ESG goals (diversity in work force, water use, etc.), and reported on progress over multiple years. Companies began reporting their [narrative] strategies to achieve ESG goals, such as reformulating products, requiring suppliers to improve performance, or reducing energy use. These were often for public relations, industry awards, or to meet stakeholder requests.

Additionally, companies have set other ESG goals (diversity in work force, water use, etc.), and reported on progress over multiple years. Companies began reporting their [narrative] strategies to achieve ESG goals, such as reformulating products, requiring suppliers to improve performance, or reducing energy use. These were often for public relations, industry awards, or to meet stakeholder requests.

Demand for ESG reporting and disclosures from the capital markets – including forward looking narratives, commitments, and goals – has changed everything. Complete, accurate ESG reporting and meaningful narrative have more financial implications when trillions of dollars (and Euros) are seeking high ESG performing investment opportunities. In summary, glittering generalities can be recognized as marketing puffery. Ambitious narrative and projections in a Form 10-K with poor planning, few resources, no strategy, and little real intent might start to look like securities fraud.

3 Attributes of ESG Reporting/

Sustainability Reporting

Bridging the Gap

To conclude, these attributes have been hiding in plain sight. Not to mention, even the SEC’s proposed rule on climate related financial disclosures isn’t groundbreaking. It bears the fingerprints of the ISSB prototype on climate related disclosures, the TCFD, and SASB before them. In turn, SASB insisted from the outset that sustainability reporting and disclosure standards required no new law. SASB simply applied sustainability knowledge, rigor and a public process to existing law, including the definition of “materiality” as set by the U.S. Supreme Court.

To conclude, these attributes have been hiding in plain sight. Not to mention, even the SEC’s proposed rule on climate related financial disclosures isn’t groundbreaking. It bears the fingerprints of the ISSB prototype on climate related disclosures, the TCFD, and SASB before them. In turn, SASB insisted from the outset that sustainability reporting and disclosure standards required no new law. SASB simply applied sustainability knowledge, rigor and a public process to existing law, including the definition of “materiality” as set by the U.S. Supreme Court.

All parties can contribute to more effective, efficient ESG reporting and disclosures.

- Internal Auditors, Management Accountants: As an ESG specialist working for many CPAs, I’ve seen accountants attempt to apply accounting rules directly to ESG. Sometimes it works, sometimes it doesn’t. Especially learning more about ESG attributes, context and drivers (including enlisting the support of specialists) accelerates progress.

- ESG Professionals: ESG professionals are passionate about the topic and seek change. For that reason, most have grown weary of pretty photos and happy talk as a proxy for ESG performance and change. The major reporting frameworks have evolved substantially over the last decade, so ESG professionals are on their way. At is heart, the GHG protocol is an accounting rule. The expectations and stakes in reporting and making to disclosures are a different realm from voluntary reporting. SASB study guides, learning and credentials offered by the Institute of Internal Auditors, and other business-oriented skills can help learn the lingo of the accountants and (internal and external) auditors.

- Second Line Auditors: Many companies have auditing functions for higher-risk areas. For example: environmental, safety, quality, IT(2), etc. Of course, some of these programs remained largely unchanged for years. However, these auditors have organizational and subject matter knowledge that could add value to the changing world of ESG risk. Second line auditors would do particularly well to step up. Likewise, Internal Audit and accountants can use them to accelerate their own journey.

(2) These “internal audit” programs are authorized by company Management, and should not be confused with Internal Audit function, which is authorized by – and reports to – the Board. The audit programs discussed here are sometimes referred to as “second line” audit programs, contrasted to Internal Audit as the “third line.” See The IIA’s Three Lines Model: An update of the Three Lines of Defense.

About Douglas Hileman

Douglas Hileman FSA, CRMA, CPEA, P.E. has over four decades of experience in Sustainability compliance, risk, reporting and audit. He is an author of COSO’s groundbreaking document Achieving Effective Internal Controls over Sustainability Reporting (ICSR). Previously, Douglas was the senior environmental management and auditing specialist on the Volkswagen Monitor Team and worked at a Big 4 firm for six years. Currently, he leads his boutique consultancy working on climate-related programs and GHG emissions reporting; Sustainability policies, reporting and audits; and other specialty needs. He has been active in the Institute of Internal Auditors for over a decade, contributing to supplemental guidance. Douglas leads a Governance & Controls work group for the Institute of Management Accountants. Also, he submitted detailed comments to the SEC on the proposed climate disclosure rule. In the final rule released March 6, 2024, there are 42 references to his comments.

Learn more about ESG Reporting

Join Douglas on October 16 for Environmental, Social & Governance (ESG) Update on Government Efforts. In this 2-hour live CPE webinar, Douglas will review key drivers where government is expected to play a role. Sometimes, even multiple roles. We will cover selected requirements, risks and responsibilities. The course will also focus on roles and opportunities for governmental auditors to monitor performance, protect stakeholder interests and add value. Additionally, the course will build on COSO’s supplemental guidance, Achieving Effective Internal Controls over Sustainability Reporting (ICSR).

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: