Hi! My name is Dana Lawrence and I’m excited to guest host a live webinar with Yellowbook-CPE.com on October 11 called Crypto Hacks, Headlines and Scandals: Governance in Emerging Technology.

In my 20 years as an audit, risk and compliance practitioner, I’ve seen how emerging technology and business trends can help and harm our communities. In this workshop, I’ve compiled key learning from my own research and work experience in the digital asset and emerging technology space. This should help you feel informed and resilient managing risks associated to emerging technology like cryptocurrency and blockchain.

I create workshops and learning opportunities that are accessible, informative and supportive. Have a question you’ve wanted to ask about crypto to someone who has worked in the space? This is your chance.

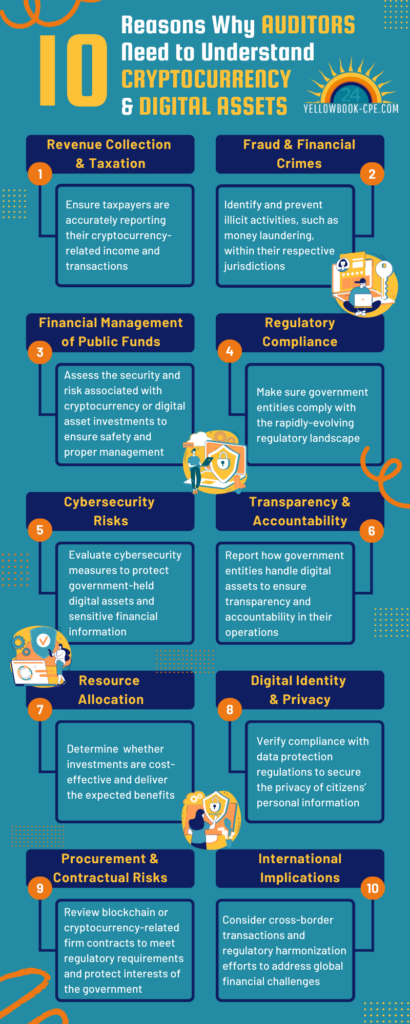

Why auditors need to know cryptocurrency and digital assets

Here are additional reasons why government auditors should pay attention to cryptocurrency and digital assets:

Revenue Collection and Taxation: Cryptocurrency transactions can be difficult to track and tax. With the increase of individuals and businesses using cryptocurrencies, there is a higher risk of tax evasion leading to decreased revenue for the government. In effect, auditors must ensure taxpayers are accurately reporting their cryptocurrency-related income and transactions.

Fraud and Financial Crimes: Cryptocurrencies are susceptible to fraud, scams and financial crimes, such as money laundering and terrorist financing, due to their pseudonymous nature. Government plays a crucial role in identifying and preventing such illicit activities within their jurisdictions.

Financial Management of Public Funds: Governments may choose to invest public funds in cryptocurrencies or digital assets as part of their investment portfolios. As a result, auditors must assess the security and risk associated with these investments to ensure the safety and proper management of public funds.

Regulatory Compliance: The regulatory landscape for cryptocurrencies and digital assets is rapidly evolving. Under those circumstances, government agencies may need to establish and enforce regulations related to the use and exchange of cryptocurrencies. Therefore, auditors must ensure government entities comply with these regulations.

Cybersecurity Risks: Cryptocurrency transactions and digital asset management are vulnerable to cyberattacks. Consequently, auditors need to continually assess the cybersecurity measures in place to protect government-held digital assets and sensitive financial information.

Transparency and Accountability: Auditors are responsible for ensuring transparency and accountability in government operations. Thus, they must evaluate how government entities handle digital assets, including issues related to custody, transparency of transactions and the use of blockchain technology for public records.

Resource Allocation: Governments may allocate resources to develop blockchain-based solutions for public services. Examples include voting systems, identity verification or supply chain management. Auditors should determine whether these investments are cost-effective and deliver the expected benefits.

Digital Identity and Privacy: Ensuring the privacy and security of citizens’ personal information is paramount. In order to do this, government auditors may need to evaluate digital identity systems built on blockchain technology. Then they must verify compliance with data protection regulations.

Procurement and Contractual Risks: Government agencies may enter into contracts with blockchain or cryptocurrency-related firms. Accordingly, auditors should review these contracts to ensure they protect the government’s interests and meet regulatory requirements.

International Implications: Cryptocurrencies and digital assets have international implications. For this reason, auditors may need to consider cross-border transactions and regulatory harmonization efforts to address global financial challenges.

Learn more on October 11

In conclusion, government auditors should care about cryptocurrency and digital assets. These technologies have the potential to transform financial systems and government operations. While they offer opportunities for efficiency and innovation, they also present substantial risks related to taxation, fraud, cybersecurity and regulatory compliance.

To summarize, auditors play a pivotal role in safeguarding government interests, ensuring transparency and managing these risks effectively. As the digital economy continues to grow, government auditors must adapt and stay informed about the evolving landscape of cryptocurrency and digital asset management.

Again, I hope to see you on October 11 for Crypto Hacks, Headlines and Scandals: Governance in Emerging Technology!

Very best,

Dana

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: